A strong FICO score is one of your most powerful tools in the United States if you want funding for businesses, real estate, or personal projects. In 2026, lenders are more strict, but the rules of the game are clear. If you understand how your score works and follow a simple plan for a few months, you can usually add 50–100 points or more.

This guide explains how FICO works and gives you a practical, step‑by‑step strategy to repair and boost your credit score as fast as possible.

1. Understand What Really Drives Your FICO Score

Your FICO score is mainly based on five factors. Knowing them helps you focus your effort where it matters most.

-

Payment history (~35%)

Whether you pay every bill on time is the single most important factor. Even one payment 30 days late can hurt your score for months. -

Credit utilization (~30%)

This is how much of your available revolving credit (mainly credit cards) you are using. If your total limits are 10,000 dollars and your balances are 5,000 dollars, your utilization is 50 percent. High utilization is one of the fastest ways to damage your score.

Length of credit history (~15%)

Lenders prefer long‑term relationships. The age of your oldest account, the age of your newest account, and the average age of all your accounts all count.

-

-

Credit mix (~10%)

Having a mix of credit types (credit cards, auto loans, student loans, mortgage) can help, but it’s less important than payment history and utilization.

New credit and inquiries (~10%)

Each time you apply for new credit, a hard inquiry usually appears on your report and can slightly lower your score, especially if you have many applications in a short time.

-

If you want fast results, you mainly focus on on‑time payments and low utilization, while avoiding unnecessary new inquiries.

2. Repair Phase: Fix the Damage on Your Credit Reports

Before you try to “boost,” you need to repair. That starts with your reports.

2.1 Get Your Reports From All Three Bureaus

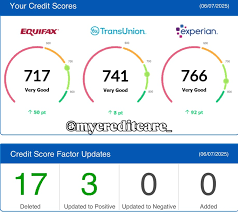

In the U.S., you have three main credit bureaus: Equifax, Experian, and TransUnion. You should get your reports from all three, because errors or problems may appear on one but not the others.

Look for:

-

Late payments that are wrong

-

Accounts that are not yours

-

Wrong balances or limits

-

Old negative items that should have aged off

2.2 Dispute Errors and Inaccuracies

If you see incorrect information, you have the right to dispute it.

-

Dispute directly with the bureau (online or by mail).

-

Attach proof: statements, letters from lenders, identity documents.

-

The bureau generally has around 30 days to investigate and respond.

Removing wrong late payments or accounts can sometimes give you a quick score increase, especially if your file is not very thick.

2.3 Deal With Legitimate Negative Items

Some negative marks are real: late payments, charge‑offs, collections. You cannot erase the truth, but you can limit the damage.

-

Bring accounts current if you are behind. Once you are back on time, every new on‑time payment slowly builds positive history.

For collections, some people negotiate “pay for delete,” but you must get any agreement in writing and understand that not all collectors will remove the item.

-

-

Avoid new late payments at all costs. A new 30‑day late can hurt more than an old one.

3. Boost Phase: 7 Fast Ways to Increase Your FICO Score

Once your reports are clean as possible, you can focus on boosting. These tools are practical for most people in 2026.

3.1 Lower Your Credit Utilization

This is one of the fastest ways to move your score.

-

Target below 30 percent total utilization, and below 10 percent if you want top‑tier scores.

-

If you have 3,000 dollars across your cards and your total limit is 10,000 dollars, you are at 30 percent.

-

Paying down revolving debt before the statement date can help the lower balance report to the bureaus.

If you can’t pay balances fast, you can also ask for credit limit increases on cards you already have, as long as that does not trigger a hard inquiry in your case. This can improve utilization without adding new debt.

3.2 Pay Every Bill on Time, Every Time

Even if you can only afford minimum payments for a while, never pay late. Payment history is about 35 percent of FICO.

Concrete tools that help:

-

Set up autopay at least for the minimum due on each card or loan.

Use calendar reminders a few days before each due date.

-

A consistent 6–12 months record of perfect payments can significantly rebuild a damaged score.

3.3 Use Credit‑Builder Products

If your profile is thin or damaged, special products can help you add positive history.

-

Credit‑builder loans – Small loans offered by credit unions or online companies. The money often sits in a locked account while you make payments, and is released at the end. Your payments are reported to the bureaus.

-

Secured credit cards – You give a deposit (for example 300 dollars), and this becomes your limit. Use it lightly and pay in full each month.

Rent or utility reporting services – Some services report your on‑time rent or utility payments to the bureaus, which can help people with little traditional credit.

-

These tools are especially useful if you want to build credit without taking large risks or big new debts.

3.4 Become an Authorized User on a Strong Account

If a trusted family member or partner has a well‑managed credit card (old account, low utilization, perfect payment history), they can add you as an authorized user.

When the bank reports authorized users to the bureaus, you can benefit from their positive history, which may boost your score—especially if your own file is thin. This only works if the main account is used responsibly.

3.5 Avoid Unnecessary New Hard Inquiries

Every hard inquiry can cost a few points and too many inquiries in a short time can scare lenders.

-

Group rate‑shopping (for example, auto or mortgage) into a short period so bureaus treat it as one event.

-

-

Avoid applying for multiple credit cards in a short time just to “test your luck.”

In many scoring models, inquiries older than 12 months have little or no impact, even though they may remain visible for up to two years.

3.6 Keep Your Oldest Accounts Open When Possible

Closing your oldest card can hurt both your average age of accounts and your available credit, which can lower your score.

Instead of closing:

-

Keep old cards open with small, regular charges that you pay in full.

-

Only close accounts with high fees that you no longer want, and understand the possible impact first.

3.7 Monitor Your Progress and Protect Your Score

Use credit monitoring tools (from banks, card issuers, or dedicated apps) so you can see changes and detect problems early.

-

Check for identity theft, new accounts you did not open, or sudden score drops.

-

Use these alerts to react quickly if something goes wrong.

4. A 90‑Day Action Plan to Boost Your FICO

Here is a simple three‑month plan readers can follow.

Month 1: Clean Up and Stabilize

-

Pull your credit reports from all three bureaus.

-

Dispute any clear errors (wrong late payments, accounts that are not yours).

-

Set up autopay on every card and loan to avoid new late payments.

-

Make a small payment to reduce utilization, even if you cannot clear all balances.

Month 2: Build Positive History

-

Open a secured card or credit‑builder loan if your credit file is thin.

-

Enroll in a rent or utility reporting service if you qualify.

-

Ask for a credit limit increase on cards in good standing (without a hard inquiry if possible).

-

Keep usage light: ideally below 30 percent on each card and overall.

Month 3: Optimize and Protect

-

Stop all non‑essential new credit applications.

-

Keep paying every bill on time, continue reducing balances.

-

Review your reports again to confirm updates from disputes and payments.

-

Consider becoming an authorized user on a strong account if you have trusted family or partners.

Many people who follow a disciplined plan like this see noticeable improvement in 3–6 months, and even more progress in 12 months.

5. Final Thoughts: Credit as a Business Tool

For individuals and entrepreneurs, a high FICO score is not just a number—it is a tool to access better interest rates, larger credit lines, and serious business funding. In 2026, banks and lenders still rely heavily on FICO to decide who gets the best terms.

By focusing on payment discipline, low utilization, clean reports, and smart use of credit‑building products, you can repair past mistakes and build a score that works for you instead of against you.